One regularly used government-bond standard to which mortgage lending institutions often peg their interest rates is the 10-Year Treasury bond yield. Typically, MBS vendors have to use greater returns because repayment is not 100% ensured as it is with federal government bonds. The progressive higher activity of costs because of inflation is a reflection of the general economic climate and also an important variable for home mortgage lending institutions. The interest rate is the amount charged in addition to the principal by a loan provider to a consumer for using possessions.

- Similar to with fixed-rate mortgages, with fixed-rate financial savings, you repair into a rate for a set amount of time, for one, two, 3 or even 5 years.

- Significance, one section of your lending is fixed while the various other is variable.

- It may appear like an odd time to be concentrating on this, yet by working toimprove your credit history, you will certainly be able to get a far better deal when your deal concerns an end or you remortgage.

- As soon as you purchase that bond, you're locked into a 2% rates of interest till the bond grows.

- Card suppliers can usually change prices as and when they want-- recently, as an example, American Express announced it would be billing its cardholders extra, condemning the increasing expense of offering rewards.

The Bank of England utilizes changes in the interest rate to choose at which level it will certainly lend money to other banks for a single day. A boost in Financial institution Rate is normally passed on wesley financial to some extent by individual banks, so people earn a lot more on their savings. Savers are commonly borrowers as well, however the money in the bank has properly been dropping in worth for some time. We're clear about exactly how we are able to bring top quality material, competitive rates, and beneficial tools to you by clarifying how we make money. Our specialists have been assisting you master your money for over 4 decades.

Find out more regarding interest rate kinds and afterwards utilize our Explore Interest Fees device to see just how this selection influences rate of interest. Various loan provider can use different finance products and prices. Regardless of whether you are wanting to purchase in a country or urban location, speaking with numerous lenders will certainly assist you understand all More helpful hints of the alternatives available to you. Prior to you begin home loan buying, your primary step must be to inspect your debt, as well as review your credit scores reports for mistakes.

We follow rigorous guidelines to ensure that our editorial content is not influenced by marketers. Our content team gets no straight settlement from advertisers, and also our web content is extensively fact-checked to make sure accuracy. So, whether you're reading a write-up or a review, you can rely on that you're getting trustworthy and dependable information.

Which Factors Affect Just How Rates Of Interest On Home Mortgages Are Established?

It's a good suggestion to have an economic strategy in position to take care of any type of potential rates of interest changes. Present projections suggest that adjustments are likely to be little, but stable, so while a 0.25% price surge could not set alarm system bells calling, several consecutive elevates can have a significant impact. This is a rates of interest applied to money that banks and various other depository establishments provide per other over night. Bankrate.com is an independent, advertising-supported publisher as well as comparison service. We are made up in exchange for placement of sponsored items and also, services, or by you clicking on particular web links posted on our site.

Just How Can Debtors Handle Changing Rates Of Interest?

If you do not understand your credit rating, there are many means to obtain it. There are a http://fernandojrub599.almoheet-travel.com/flexible-rate-home-loan host of different variables that go into how a lender establishes the rate of interest on its home loan array. This is since you're paying a little bit much more for the protection of knowing what your payments will resemble each month. With many mortgage offers, your interest rate will certainly go back to your loan provider's SVR after the first period pertains to an end. SVRs have a tendency to be relatively high, so it often makes sense to switch - or remortgage- before you're relocated onto the SVR. While your lending institution might not raise its SVR by the full amount, it's still very likely that your settlements will certainly increase.

Projecting Adjustments

The rates of interest charged by banks is established by a variety of elements, such as the state of the economic climate. A country's central bank sets the rates of interest, which each bank uses to identify the variety of annual percentage rates they offer. Federal Get Chairman Jerome Powell revealed Wednesday the Fed will certainly decrease its bond buying program to fight rising cost of living. These policy modifications are anticipated to create increasing mortgage prices following year. As you check out potential interest rates, you may discover that you can be supplied a somewhat lower rate of interest with a deposit just under 20 percent, compared to among 20 percent or higher.

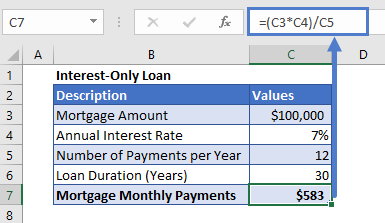

As an example, if you take out a $400,000 lending on a 6.5% rates of interest over 25 years, you will certainly pay greater than $400,000 in rate of interest. If you would like to know the amount that goes in the direction of your passion knowledgeables principal, you can make use of ourhome lending calculatorto see the difference. When you get a home loan the cash you obtain is called the principal, while the interest rate is the charge for borrowing the cash, shared as a percentage per year. Our team believe everybody needs to have the ability to make financial decisions with self-confidence.

It's additionally feasible for the interest rate on your credit card or overdraft account to climb, although they are not directly linked any adjustment in the BoE base price. You'll be notified prior to this occurs, based on the conditions of your account. If your home mortgage payments are likely to increase, work out if you can manage the increase.Create a budgetand see if there are any type of areas you might be able to cut back. If the increases are likely to be in the future, then start developing a financial savings buffer so you'll have the ability to afford your mortgage when they hit. Brokers are expecting any increases in home loan prices to be "slow-moving as well as measured", which would certainly suggest mortgages would remain cheap by historical standards for a long time. For houses, that could imply greater mortgage costs, although - for the huge bulk of home owners - the impact is not instant, and also some will certainly escape it completely.